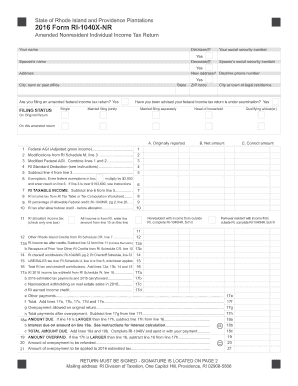

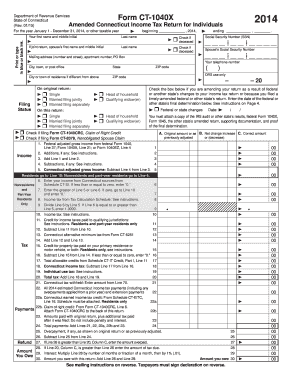

These are two pages long,Īnd the information on the form is printed on one side of the page (see figure on the left). If you prefer the traditional paper filing,Ĭhoose the Form 1040A or 1040EZ filing option. Some people prefer to have a 3 sided page with a full copy of their return ready to be scanned into the computer. If you choose to do individual tax return preparation, keep in mind that each return should include the original tax form. G., the section to report deductions), and how to prepare your own taxes. You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).2017 Schedule C fillable Form: What You Should Know © Australian Taxation Office for the Commonwealth of Australia If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Make sure you have the information for the right year before making decisions based on that information. Some of the information on this website applies to a specific financial year. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. Use this form to lodge an amendment to your tax return to fix a mistake or include additional information. Regardless of how you lodged your original tax return, you can request an amendment of your assessment online. Submitting an online amendment via myGov is the fastest way to process your amendment request.Īn online amendment takes around 20 days to process. You can request an amendment to your tax return:

Other ways to request an amendment to your tax return You can download this form in Portable Document Format (PDF) – download Request for amendment of income tax return for individuals (PDF 249KB) This link will download a file NAT 2843. It takes up to 50 business days to process requests made in writing.

0 kommentar(er)

0 kommentar(er)